2017 Australian Budget

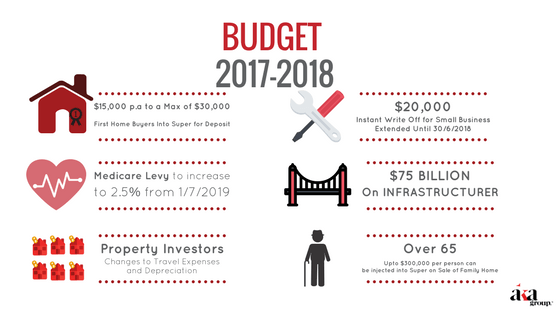

Wondering what last night's Budget means for you? A quick wrap of some key announcements.

PERSONAL TAX

Property Investors:

1. As of 1 July 2017 Travel Expenses will no longer be deductable. So if you purchased an investment property interstate or overseas, taking a trip to inspect it, will no longer claimable, as is travel to undertake maintenance or collect rent.

2. As of 9 May 2017 depreciation on plant & equipment that are part of the original purchase price of property will no longer be deductable, such items dishwashers, air condition, ceiling fans. Those that purchased prior to Budget Night will still have access to this deduction. The deduction will also apply to investors who purchase plant and equipment in the normal cause of owning a property. E.g 12 month in you need to replace Stove.

MEDICARE, we all pay it, for most there will be an increase

• The threshold for singles will be increased to $21,655. (So if income under this, no medicare levy payable)

• The family threshold will be increased to $36,541 plus $3,356 for each dependent child or student.

• For single seniors and pensioners, the threshold will be increased to $34,244.

• The family threshold for seniors and pensioners will be increased to $47,670 plus $3,356 for each dependent child or student.

For most the Medicare levy from 1 July 2019 will increase from 2% to 2.5% of taxable income, so e.g for those earning $50,000 a year an extra $250.00 will be payable

SMALL BUSINESS, no major announcement here, from what already introduced,

The $20,000 immediate write-off for small business will be extended until 30 June 2018, was to cease on 30 June 2017.. This is available to Small Business with an aggregated annual turnover of less than $10 million. This means small businesses will be able to immediately deduct purchases of eligible assets costing less than $20,000 first used or installed ready for use by 30 June 2018.

A reminder this is simply a timing issue, and as a small business your cashflow should always be considered before jumping in to spend. An example you're a Small Business trading via a Company and you go out and spend $20,000 before 30 June 2017 or 2018 on equipment, tax saving $5,500.00 so from a cashflow point you are out by $14,500 or you just increased your debt by $20,000 as you have financed the purchase. If you really need the equipment that is ok, take advantage of the immediate write off, but if the decision is driven by tax saving rethink spend.

Small business CGT concessions The Government will amend the small business CGT concessions with effect from 1 July 2017 to ensure that the concessions can only be accessed in relation to assets used in a small business or ownership interests in a small business. This proposed amendment is targeted at taxpayers who are able to access these concessions for assets which are unrelated to their small business, for instance through arranging their affairs so that their ownership interests in larger businesses do not count towards the tests for determining eligibility for the concessions. The small business CGT concessions will continue to be available to small business taxpayers with aggregated turnover of less than $2 million or business assets less than $6 million.

SUPERANNUATION

Still out on this, will it really help first homeowners. How many potential first home owners are able to salary scarfice $15,000 a year from there pay, but at least it is heading in right direction by offering some tax relief to help with that deposit. So what is on offer, The First home superannuation saver scheme - The Government will encourage home ownership by allowing first homebuyers to 'build a deposit' inside their superannuation fund, as follows:

Voluntary superannuation contributions of up to $15,000 per year, and $30,000 in total, can be contributed by first homebuyers from 1 July 2017. The contribution must be within existing concessional and non-concessional caps. (and this is where the first issue lies, as for many what they will be able to inject will be $25,000 (The Concessional Cap as of 1/7/2017 Less Employer Contribution, and this balance cannot be more than $15,000)

The Government has created the First Home Super Saver Estimator to show potential users what they could reach. As you will see with the limits imposed amounts nowhere near to allow entry to the Australian Capital City Property market. So if your goal is to own property, get in contact with us to discuss real possibilities.

Now for the biggest joke in the budget, allowing Individuals aged 65 or over to contribute the proceeds of downsizing into superannuation From 1 July 2018, the Government will allow a person aged 65 or over to make a Non Concessional Contribution of up to $300,000 from the proceeds of selling their home.

Does anyone else see an issue with this? Cashed up baby boomers "downsizing", and what will they be downsizing to? Chances are will be properties that are attractive to first home buyers, based on entry price. I do not believe that giving this incentive to over 65 will result in more affordable property hitting the market. Could the government have other plans? E.g Getting more Seniors off the age? As at present not clear if the $300,000 will be counted towards the asset test for the age pension.

From 1 July 2018, the Government will further improve the integrity of the superannuation system by reducing opportunities for members to use related party transactions on non-commercial terms to increase superannuation savings. The non-arm's length income provisions will be amended to ensure expenses that would normally apply in a commercial transaction are included when considering whether the transaction is on a commercial basis

GST

Improving the integrity of GST on property transactions From 1 July 2018, purchasers of newly constructed residential properties or new subdivisions will be required to remit the GST directly to the ATO as part of settlement. Under the current law (where the GST is included in the purchase price and the developer remits the GST to the ATO), some developers are failing to remit the GST to the ATO despite having claimed GST credits on their construction costs. As most purchasers use conveyancing services to complete their purchase, they should experience minimal impact from these changes.

Aligning the treatment of digital currency (e.g., bitcoin) with money From 1 July 2017, the Government will align the GST treatment of digital currency (e.g., Bitcoin) with money. Digital currency is currently treated as intangible property for GST purposes. Consequently, consumers who use digital currencies as payment can effectively bear GST twice: once on the purchase of the digital currency and again on its use in exchange for other goods and services subject to GST. This measure will ensure purchases of digital currency are no longer subject to the GST. 6. Measures affecting foreign investors

INFRASTRUCTURE SPENDING

Will hold judgment on this, as it was announced $75 Billion will be injected over 10 years, This will be good for the overall economy as such large spending will always increase job opportunities.

And now for a few other announcements to keep you amused,

- Restrictions will be placed on property developers, to prevent them from selling more than 50% of new development to foreign investors

- Impose an Annual Levy of $5000 on future foreign investors who fail to occupy or lease property for at least 6 months of the year, also Foreign and temporary tax residents will no longer be exempt from capital gains tax when selling main residence in Australia.

- Proposed changes to Crowd Source Equity to allow Proprietary Companies to access funds along with steps to increase competition within the financial sector.

- Those with Student debt will now start paying back when income reaches $42,000 as of 1 July 2018 (currently $54,869)

- Australian Taxation Office (ATO) will be provided with extra funding to collect more tax, so if you are a business owner consider taking out an Audit Insurance Policy to help with costs should ATO come knocking.

As always if you have any concerns on how any of the above will impact your business or house hold, please get in contact with us at success@akagroup.com.au or 02 8338-9600

The above in no way is to be taken as advice and it is general in nature. Also as this is based on Budget announcements, they are not yet law so please check before you take action.